KTC, in collaboration with the Technology Crime Suppression Division (TCSD) of the Royal Thai Police, hosted the "KTC FIT Talk" under the theme "Stay Ahead of Cyber Threats: Protecting Identity and Finances in the Digital Age." The forum addressed the fast-evolving landscape of cybercrime—from phishing and call-center scams to the rise of Artificial Intelligence (AI) and Agentic AI in exploiting financial systems. The discussion highlighted the urgent need for cross-sector collaboration among government agencies, financial institutions, tech companies, and the media to strengthen digital resilience across Thai society.

Pol.Col.Suriyasak Jirawas Superintendent of Sub-division 3,Crime Suppression Division, Central Investigation Bureau (TCSD), Royal Thai Police, highlighted the growing sophistication of cybercrime in Thailand. "Cases now include high-yield investment scams, fake mobile applications, and deepfake technology that mimics voices and visuals of trusted individuals. Victims span all demographics, with social media and websites being the most exploited channels. According to recent data, individuals aged 25-40 are most affected, accounting for 70% of reported cases, with women representing more than 60%. Residents due to higher digital engagement and exposure to online platforms or social media for around 80% of all cases."

He emphasized that enforcement alone is insufficient. Proactive prevention, timely public alerts, and cross-sector collaboration are essential. The Royal Thai Police is advancing data protection and cybercrime legislation, while banks share fraud trends via the Thai Bankers' Association and the Fraud Working Group. Telecom and social media platforms are helping block scam numbers and fake sites. The media plays a vital role in delivering verified information to build public awareness. Despite progress, challenges remain—particularly the lack of a centralized data-sharing system and the need for faster coordination to respond to emerging threats.

Mr. Rywin Voravongsatit, Head of Operations Control and Merchant Operations, explained that "Financial fraud has moved far beyond stolen card details and phishing emails. It later evolved into phishing via email and SMS with malicious links. Today, we're seeing deepfake technology—both voice and video—used to impersonate officials and deceive victims. With the rise of Generative AI, the threat has intensified, as fake content can now be created instantly. While these scams are still reactive, the emergence of Agentic AI marks a turning point. These systems can plan and execute attacks autonomously in real time. For example, a 'ShopSmart Agent' can set up fake online stores, harvest credit card data, and initiate automated transactions across countries. This reflects how rapidly financial threats are evolving."

"Recent data shows that over 86% of cybercrime losses stem from data compromise, with stolen card information used for overseas transactions. Traditional scams—such as call-center fraud and fake SMS—remain widespread, often tricking victims into transferring money or investing through impersonation of government or bank officials. The most alarming trend is the misuse of personal data, especially OTPs, which have become a key weapon for fraudsters. We urge everyone to pause and verify before clicking any suspicious links or sharing sensitive information. Never disclose your CVV or OTP, and always enable transaction alerts and spending limits via mobile banking. KTC Digital Card, with its dynamic CVV, offers enhanced protection for both online and offline transactions. If you suspect fraud, immediately block your card and change your password. Importantly, banks will never send links via SMS to request personal information—always contact the call center directly to verify."

"At KTC, we monitor all transactions 24/7 in real time via the KTC Mobile app. If a suspicious transaction is detected, our team will call the customer directly. We also educate the public through social media platforms like TikTok, Facebook, our website, and LINE OA to raise awareness and build digital immunity. Our commitment to financial security has been recognized with regional awards, including the Asia-Pacific Champion Security Award and Best in Class Performance (Thailand) from Visa. These accolades reflect our leadership in financial technology and our adherence to global standards in risk management and data security—ensuring that every KTC member can transact with confidence."

Mr. Noparat Suriya, Head of Card & Merchant Prevention Division, added that KTC works closely with CIB of the Royal Thai Police to share intelligence and help prevent fraudulent activities, including major credit card forgery cases that have made headlines. Our goal is to protect both our members and society from financial harm. We also urge families to play an active role in safeguarding elderly members, who are often targeted by scammers. Key recommendations include:

- Regular conversations about online safety

- Monitoring SMS and transaction alerts

- Setting spending limits on cards

- Installing spam-filtering apps like Whoscall

- Staying updated on emerging cyber threats

If KTC members receive suspicious messages, emails, or phone calls, they can report and verify them 24/7 via KTC PHONE 02 123 5000, Line@KTC_Card, or any of our online channels. These platforms are designed to be accessible and user-friendly, ensuring secure transactions and peace of mind for all members.

TFM ยืนหนึ่งไตรมาส 3/2568 กวาดรายได้ 1,694 ลบ. โต 21.9% โกยกำไรสุทธิเพิ่ม 47.8% สูงสุดเป็นประวัติการณ์ ตอกย้ำการเป็นผู้นำธุรกิจอาหารสัตว์น้ำยั่งยืน

TFM ยืนหนึ่งไตรมาส 3/2568 กวาดรายได้ 1,694 ลบ. โต 21.9% โกยกำไรสุทธิเพิ่ม 47.8% สูงสุดเป็นประวัติการณ์ ตอกย้ำการเป็นผู้นำธุรกิจอาหารสัตว์น้ำยั่งยืน

TIDLOR Appreciates Investor Trust for Overwhelming Debenture Support Reaffirming Focus on Robust and Quality Growth

TIDLOR Appreciates Investor Trust for Overwhelming Debenture Support Reaffirming Focus on Robust and Quality Growth

TIDLOR ขอบคุณผู้ลงทุน หุ้นกู้ได้รับความสนใจเป็นจำนวนมาก พร้อมเดินหน้าสร้างการเติบโตอย่างแข็งแกร่งและมีคุณภาพ

TIDLOR ขอบคุณผู้ลงทุน หุ้นกู้ได้รับความสนใจเป็นจำนวนมาก พร้อมเดินหน้าสร้างการเติบโตอย่างแข็งแกร่งและมีคุณภาพ

EXIM BANK ได้รับการประกาศเกียรติคุณจาก Sustainism Initiatives บนเวทีสหประชาชาติ ตอกย้ำบทบาทผู้นำด้านการเงินเพื่อความยั่งยืน

EXIM BANK ได้รับการประกาศเกียรติคุณจาก Sustainism Initiatives บนเวทีสหประชาชาติ ตอกย้ำบทบาทผู้นำด้านการเงินเพื่อความยั่งยืน

EXIM Thailand is Honorably Recognized from the Sustainism Initiatives at the United Nations Forum, Underlining its Role as a Leader in Sustainable Finance

EXIM Thailand is Honorably Recognized from the Sustainism Initiatives at the United Nations Forum, Underlining its Role as a Leader in Sustainable Finance

Bangchak Reaffirms Strong Financial Position with A+ TRIS Credit Rating for Second Consecutive Year

Bangchak Reaffirms Strong Financial Position with A+ TRIS Credit Rating for Second Consecutive Year

บางจากฯ ฐานะทางการเงินแข็งแกร่ง คงระดับเครดิต A+ จากทริส เรทติ้ง ต่อเนื่องเป็นปีที่ 2

บางจากฯ ฐานะทางการเงินแข็งแกร่ง คงระดับเครดิต A+ จากทริส เรทติ้ง ต่อเนื่องเป็นปีที่ 2

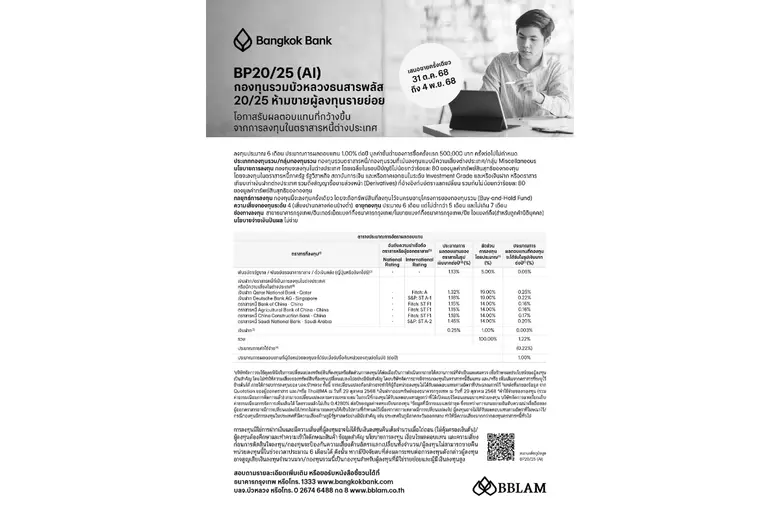

BBLAM เสนอขาย IPO 'BP20/25(AI)' วันที่ 31 ต.ค. - 4 พ.ย. 2568

BBLAM เสนอขาย IPO 'BP20/25(AI)' วันที่ 31 ต.ค. - 4 พ.ย. 2568