EXIM Thailand Provides ESG Loan to Combat Global Warming and Climate Change

EXIM Thailand has pointed out that global warming and climate change have been intensifying and caused the rises in costs of business operations. The Bank is, therefore, fully ready to cooperate with the public and private sectors in accelerating expansion of loans for improvement of manufacturing processes to assist Thai business entities in reduction of greenhouse gas (GHG) emissions and compliance with environmental standards.

Dr. Rak Vorrakitpokatorn, President of Export-Import Bank of Thailand (EXIM Thailand), remarked that global warming and climate change are the major causes of several natural disasters around the world and have threatened the safety of lives and properties, as well as impeded development in economic, social and environmental dimensions and pushed up operation costs of all sectors. According to the Economist Intelligence Unit (EIU), the world's leading resource for economic and business research, global warming is predicted to directly cause a surge in global economic costs by as high as 7.9 trillion US dollars by 2050. There has thus been broad ranging integration of cooperation at both national and international levels to set the target for reduction of GHG and carbon dioxide emissions. For example, the 26th UN Climate Change Conference (COP26) in Glasgow of Scotland has reached a conclusion for participating countries to limit the climate change and to end the use of fossil fuels. Thailand has accordingly targeted to reduce carbon dioxide emissions in order to drive Carbon Neutrality by 2065, while the European Union (EU) has worked out a new industrial development strategy involving a mechanism called Carbon Border Adjustment Mechanism (CBAM) which outlines criteria to lessen cost advantage of imported goods from countries outside the EU, and the US and countries elsewhere are considering to issue measures to impose import duties based on the extent of carbon emissions. These measures would directly affect business sectors and supply chains of global economy. Therefore, exporters in countries around the world, including Thai exporters, need to make a fast move to improve their production processes to reduce GHG emissions or buy carbon credit as a compensation.

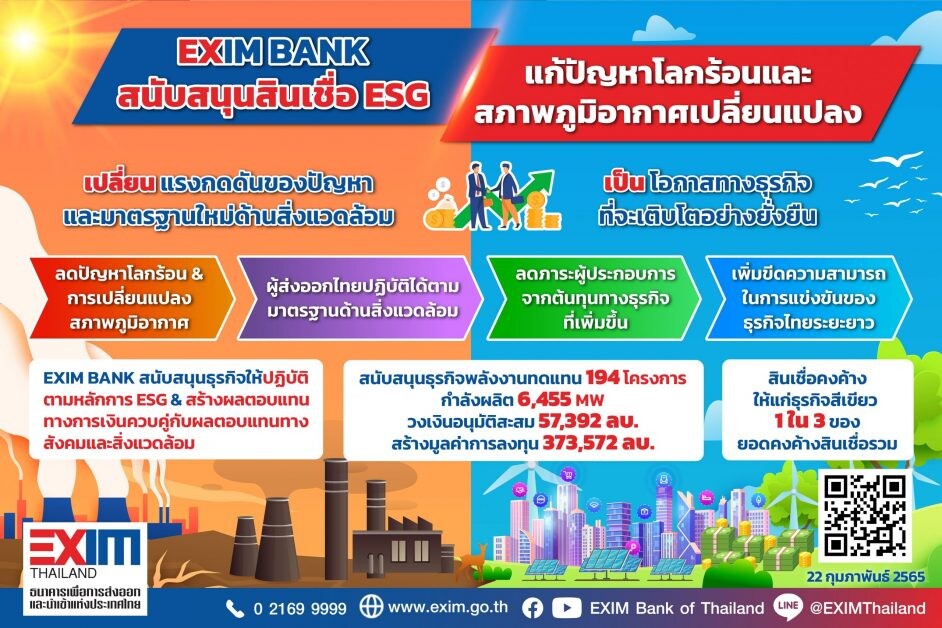

EXIM Thailand President said that EXIM Thailand, as a specialized financial institution with the role to support national development and promote international trade and investment, has all along placed on the top of its agenda performance of duty as a good citizen of the world. The Bank has operated business under corporate governance and corporate social responsibility in its work process and with responsiveness to the demand and expectations of its stakeholders toward responsible and sustainable banking. It has carried out its mission to "reboot, restructure, rebalance and resynergize" development of Thai industries and entrepreneurs. Most importantly, as Thai and global economies are on the recovery pace at present, building of industries for the future should be accelerated and carried on in response to such trend by way of transformation of the "pressures from new environmental standards and emerging problems" into "business opportunities" for businesses to grow sustainably alongside the society and the environment. In view of such circumstances, EXIM Thailand has thus worked out and executed a responsible finance management policy, aiming to support businesses hit by challenges in environmental, social and governance (ESG) dimensions in conjunction with supporting businesses committed to generating financial returns along with social and environmental returns, such as green businesses and renewable energy power plants both domestically and overseas. EXIM Thailand has for the past decades rendered financial facilities to more than 194 renewable energy power projects with a total generating capacity of 6,455 MW, contributing to investment value of 373,572 million baht. Such green financing of EXIM Thailand represents one-third of its overall outstanding loan portfolio.

EXIM Thailand President further said that EXIM Thailand has developed products to support Thai entrepreneurs' adaptation to the ESG framework and international environmental standards, including movement to reduce GHG emissions. These product schemes include "EXIM Biz Transformation Loan" to support investment for improvement of efficiency in production process with offering of lowest interest rate of 2% per annum, credit line of up to 100 million baht per entrepreneur and 7-year repayment term; and "Solar Orchestra Loan" in collaboration with Thailand Greenhouse Gas Management Organization, Global Power Synergy Plc., Combined Heat and Power Producing Co., Ltd., and Neo Clean Energy Co., Ltd. to support investment in installation of solar rooftop systems for power generation and registration for sales of carbon credits for Thai entrepreneurs under EXIM Thailand's financial support covering 100% of investment cost, with offering of lowest interest rate of 2.75% per annum and 7-year maximum repayment term.

Besides provision of financial support for investment in eco-friendly businesses and enhancement of production efficiency, which is part of the efforts to reduce and relieve global warming impacts, EXIM Thailand has also participated in initiating and driving cooperation with both public and private sectors by joining as founding member and committee member in several organizations which have establishment objectives to promote development of and investment in green businesses, namely Thailand Carbon Neutral Network, Carbon Market Club and RE100 Thailand Club which is in the process of development and establishment of Thailand's carbon trade exchange with a view to supporting Thai businesses' achievement of the Carbon Net Zero target and development of collaboration mechanism to provide financial support for businesses that take part in reduction or relief of global warming.

"EXIM Thailand is fully equipped with expertise and cooperation networks both at home and overseas to design and provide services to reboot, restructure, rebalance and resynergize development of Thai industries and entrepreneurs so that they can well compete in the long run alongside enhancement of sustainable social development and environmental management. Our undertaking as such has placed us on track to achieve the United Nations' Sustainable Development Goals (SDGs). We remain steadfast in working and paving way for supporting Thai entrepreneurs' fast adjustments and revival of their businesses amid the Next Normal context along with solutions of global environmental crisis which needs drastic cooperation from all sectors and all countries across the world to generate concrete outcomes toward creation of a better world and a better tomorrow," added Dr. Rak.

ติดต่อเราได้ที่ facebook.com/newswit