EXIM Thailand Responds to BOT with Launch of Rehabilitation Credit and Debt Set-off Asset Transfer Schemes

EXIM Thailand Responds to BOT with Launch of Rehabilitation Credit and Debt Set-off Asset Transfer Schemes and Announces Growth of Loan and Export Insurance in Q1/2021

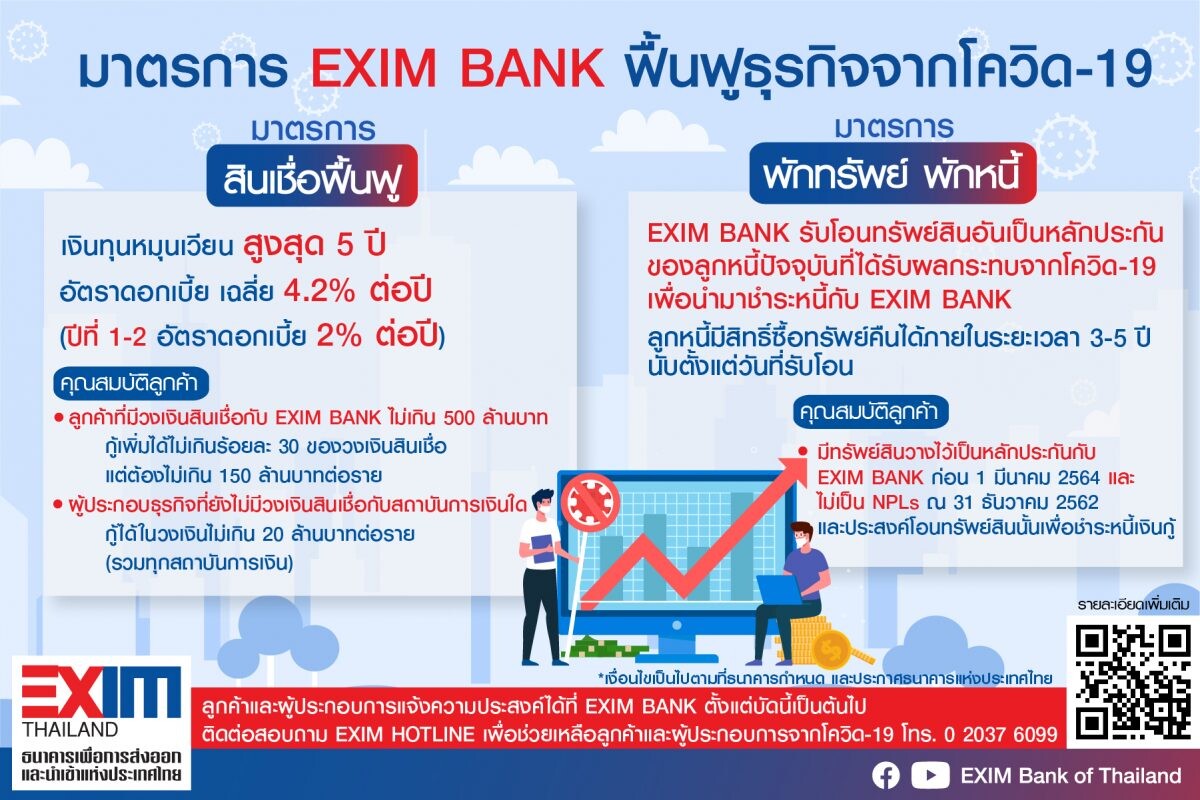

Dr. Rak Vorrakitpokatorn, President of Export-Import Bank of Thailand (EXIM Thailand), said that EXIM Thailand has launched two relief schemes in response to the additional financial measures rolled out by the Bank of Thailand (BOT) to assist and revive entrepreneurs affected by the COVID-19 pandemic as follows:

- Credit Facility Support Scheme for Entrepreneurs (Rehabilitation Credit) offering a revolving credit facility with a maximum tenure of 5 years at an average interest rate of 4.2% per annum whereby the interest rate in the 1st-2nd years is 2% per annum.

- Client having credit line of not exceeding 500 million baht with EXIM Thailand may apply for an additional credit amount of not exceeding 30% of the credit line as of December 31, 2019 or as of February 28, 2021, whichever is higher, but not exceeding 150 million baht per client (including the soft loan amount earlier received pursuant to the Emergency Decree on Provision of Financial Assistance enacted in 2020).

- Entrepreneur having no credit line with any financial institution as of February 28, 2021 may apply for a credit amount of not exceeding 20 million baht per entrepreneur (including all credit amounts from all financial institutions). - Debt Set-off Asset Transfer Scheme (Asset Warehousing)

EXIM Thailand will accept transfer of collateral assets of the Bank's existing debtors affected by the COVID-19 for debt payment to the Bank. This aims to temporarily reduce business operators' financial costs and shield them from having to sell their assets at fire-sale prices. They also have an option to buy back the assets within 3-5 years from the asset transfer date.

At present, around 940 clients of the Bank have shown their interest in applying for assistances under the above schemes, involving a total amount of approximately 5,000 million baht. Interested entrepreneurs may apply for or enquire about the assistances under the above schemes via EXIM HOTLINE for Assistances to Clients and Entrepreneurs Affected by COVID-19 Tel. 0 2037 6099.

EXIM Thailand President revealed that in the first 3 months (January-March) of 2021, as Thai and global economies had yet to fully recover from the COVID-19 crisis, EXIM Thailand has expanded its role in supporting Thai entrepreneurs financially with provision of credit and insurance facilities and non-financially with offering of other assistances on a consistent basis. The Bank recorded total outstanding loans of 134,412 million baht, an 8,276 million baht or 6.56% growth year-on-year, comprising 31,648 million baht in trade finance and 102,764 million baht in project finance. The Bank's loan approvals contributed to a business turnover of 42,246 million baht, of which 14,399 million baht or 34.08% came from SMEs.

In the support for Thai entrepreneurs' expansion of trade and investment abroad, as of the end of March 2021, EXIM Thailand recorded a total accumulated loan approval amount of 92,907 million baht for international projects, with outstanding loans accounting for 60,145 million baht, an 8,605 million baht or 16.69% growth year-on-year. Of this total outstanding loan amount, 43,485 million baht was to support entrepreneurs with export and investment in new frontier markets, including CLMV, constituting a year-on-year growth of 4,273 million baht or 10.90%. This has reflected EXIM Thailand's commitment to encouraging Thai entrepreneurs to penetrate new frontiers, particularly Vietnam which has high economic stability and growth.

As regards provision of export credit and investment insurance facilities to enhance Thai exporters and investors' confidence under the current circumstances where buyers overseas are likely to delay payment or make no payment, in the first 3 months of 2021, the Bank recorded 52,366 million baht in export credit and investment insurance business turnover, up by 15,676 million baht or 42.73% year-on-year.

In the first quarter of 2021, EXIM Thailand recorded an operating profit of 502 million baht. However, due to the impacts from the COVID-19 pandemic, the Bank recorded NPL ratio of 4.19% as of the end of March 2021 with total NPL amount of 5,625 million baht. As the Bank set aside allowance for expected credit loss of 12,396 million baht, its NPL coverage ratio was as high as 220.36%. This has resulted in the Bank's strong financial position. The Bank thus posted a net profit of 92 million baht in January-March 2021.

"In 2021, EXIM Thailand will perform as a 'new model engine' to drive Thailand's long-term sustainable export and economic growth with twin turbo propeller, i.e. being 'Thailand Development Bank' to grow Thai investment both at home and abroad on a sustainable basis alongside 'One Stop Trading Facilitator for SMEs' to build Thai economic warriors in conjunction with development of products and services in response to new preference trends. This aims to support and take appropriate action to assist Thai entrepreneurs amid the highly uncertain business environment today," added Dr. Rak.

ติดต่อเราได้ที่ facebook.com/newswit